Uploading Documents

The following

steps and screen shots will assist you with how to submit documents

electronically for the following programs:

·

Insurance

premiums tax & Health cost recovery

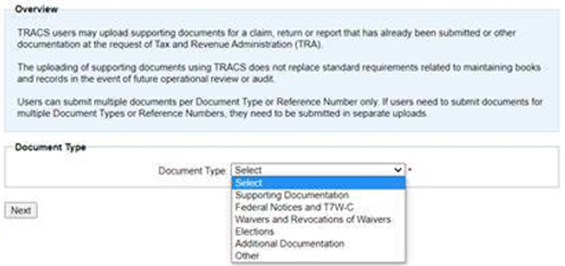

Step 1 of 3: Submit Documents – Document Type (Image 1

& Table 1)

a.

TRACS

users may upload supporting documents for a return or reassessment that has

already been submitted or other documentation as required.

b.

Select

the document type from the drop-down menu.

Image 1: Document Type

selection for corporate income tax.

c.

Enter

the in process Reference Number (if required.) This field is mandatory for

certain document types. Refer to the table below for more information:

|

Program

Name |

Allowable

File Types |

Document

Type in TRACS |

Reference

Number Required? |

|

Corporate income tax |

·

PDF

files ·

Image

files ·

Microsoft

Office Document files ·

Text

files |

Supporting

Documentation |

Yes |

|

Elections |

No |

||

|

Federal

Notices & T7W-C |

No |

||

|

Additional Documentation |

No |

||

|

Waivers

and Revocations of Waivers |

No |

||

|

Other |

No |

Table 1: Document Type Table

i. Ensure the Reference Number is in

process.

ii. Refer to View Assessment Status to find

a reference number for a specific return or tax year end in process.

iii. Select the appropriate document type to

upload a document to a tax year end or return that was previously assessed.

d.

Users

can submit multiple documents per Document Type or Reference Number. Separate

Submit Document uploads are required if multiple document types or reference

numbers need to be selected.

e.

Select

‘Next’ to continue.

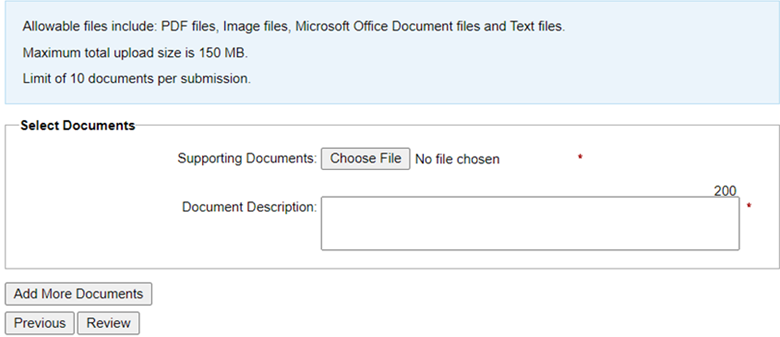

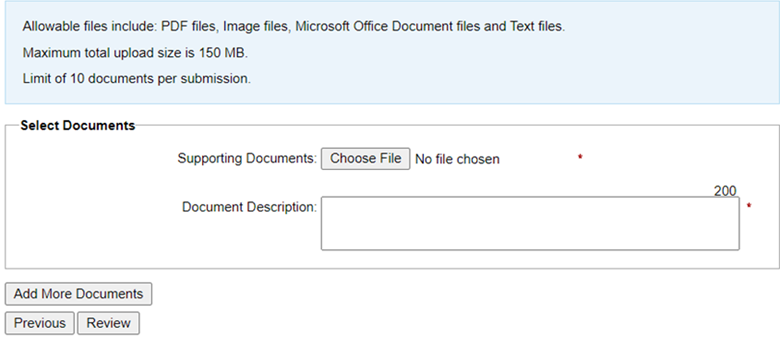

Step 2 of 3: Choose File(s) (Image 2)

a.

Click

on ‘Choose File’ to select a file to upload.

b.

Enter

a brief description of the document in the ‘Document Description’ field.

c.

Select

‘Add More Documents’ to upload more files.

d.

Select

‘Review’ once all files have been uploaded.

Image 2: Select Documents

Step 3 of 3: Review & Submit

a.

Review

the select files and document descriptions provided.

b.

Select

‘Previous’ to add more files or make changes.

c.

Select

‘Submit’ to complete the upload.

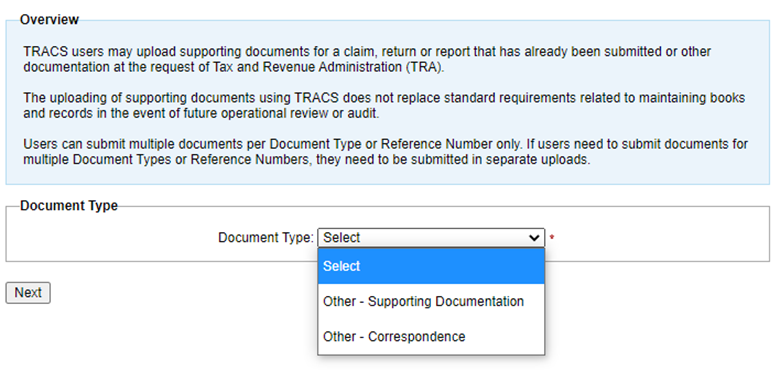

Insurance premiums tax & Health cost recovery

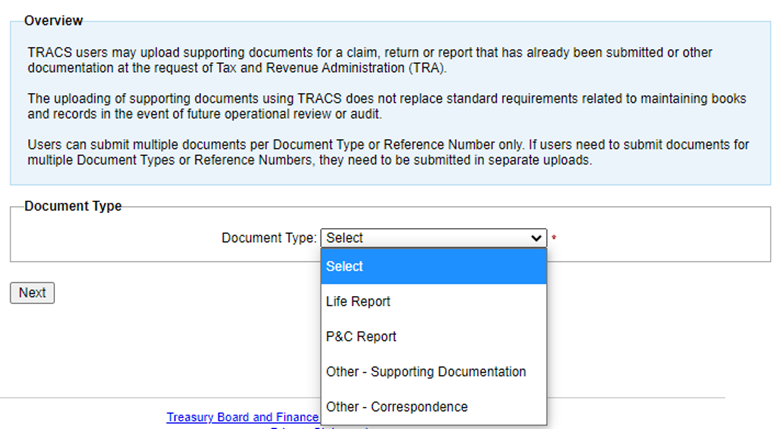

Step 1 of 3: Submit Documents – Document Type (Image 3

& Table 2)

a.

TRACS

users may upload supporting documents for a return that has already been

submitted or other documentation as required.

b.

Select

the document type from the drop-down menu.

Image 3: Document Type

selection for insurance premiums tax and health cost recovery

c.

Enter

the in process Reference Number (if required.) This field is mandatory for

certain document types. Refer to the table below for more information:

|

Program

Name |

Allowable

File Types |

Document

Type in TRACS |

Reference

Number Required? |

|

Insurance premiums tax Health cost recovery |

·

PDF

files ·

Image

files ·

Microsoft

Office Document files ·

Text

files |

Life

Report |

Yes |

|

P&C Report |

Yes |

||

|

Other –

Supporting Documentation |

No |

||

|

Other - Correspondence |

No |

Table 2: Document Type Table

for insurance premiums tax and health cost recovery.

i.

Refer

to View Assessment Status to find a reference number for a specific return or

period end.

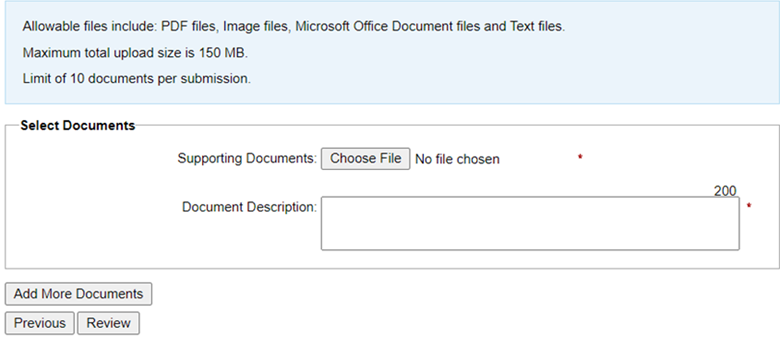

Step 2 of 3: Choose File(s) (Image 4)

e.

Click

on ‘Choose File’ to select a file to upload.

f.

Enter

a brief description of the document in the ‘Document Description’ field.

g.

Select

‘Add More Documents’ to upload more files.

h.

Select

‘Review’ once all files have been uploaded.

Image 4: Select Documents

Step 3 of 3: Review & Submit

d.

Review

the select files and document descriptions provided.

e.

Select

‘Previous’ to add more files or make changes.

f.

Select

‘Submit’ to complete the upload.

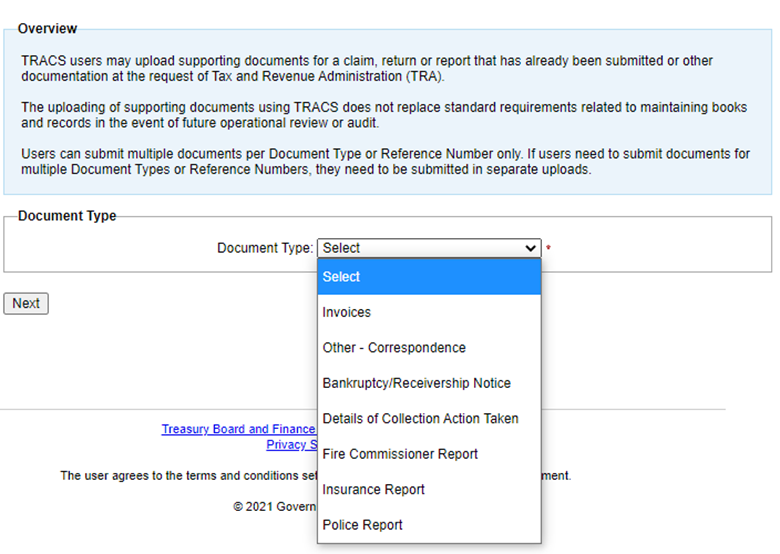

Step 1 of 3: Submit Documents – Document Type (Image 5

& Table 3)

a.

TRACS

users may upload supporting documents for a return that has already been

submitted or other documentation as required.

b.

Select

the document type from the drop-down menu.

Image 5: Document Type

selection for tobacco tax

c.

Enter

the in process Reference Number (if required.) This field is mandatory for

certain document types. Refer to the table below for more information:

|

Program

Name |

Allowable

File Types |

Document

Type in TRACS |

Reference

Number Required? |

|

Insurance premiums tax Health cost recovery |

·

PDF

files ·

Image

files ·

Microsoft

Office Document files ·

Text

files |

Invoices |

Yes |

|

Bankruptcy/Receivership

Notice |

No |

||

|

Details

of Collection Action Taken |

No |

||

|

Fire Commissioner Report |

No |

||

|

Insurance

Report |

No |

||

|

Police Report |

No |

||

|

Other -

Correspondence |

No |

Table 3: Document Type Table for

tobacco tax.

i.

Refer

to View Assessment Status to find a reference number for a specific return or

period end.

Step 2 of 3: Choose File(s) (Image 6)

d.

Click

on ‘Choose File’ to select a file to upload.

e.

Enter

a brief description of the document in the ‘Document Description’ field.

f.

Select

‘Add More Documents’ to upload more files.

g.

Select

‘Review’ once all files have been uploaded.

Image 6: Select Documents

Step 3 of 3: Review & Submit

g.

Review

the select files and document descriptions provided.

h.

Select

‘Previous’ to add more files or make changes.

i.

Select

‘Submit’ to complete the upload.

Includes:

Tourism Levy, IFTA, Fuel Tax, AITE Retailer, Tax Exempt Fuel Sales (TEFS), LPG

and 911 Levy.

Step 1 of 3: Submit Documents – Document Type (Image 7

& Table 4)

a.

TRACS

users may upload supporting documents for a return that has already been

submitted or other documentation as required.

b.

Select

the document type from the drop-down menu.

Image 6: Document Type

selection for Tourism Levy, IFTA, Fuel Tax, AITE Retailer, Tax Exempt Fuel

Sales (TEFS), LPG and 911 Levy

c.

Enter

the in process Reference Number (if required.) This field is mandatory for

certain document types. Refer to the table below for more information:

|

Program

Name |

Allowable

File Types |

Document

Type in TRACS |

Reference

Number Required? |

|

Insurance premiums tax Health cost recovery |

·

PDF

files ·

Image

files ·

Microsoft

Office Document files ·

Text

files |

Other –

Supporting Documentation |

Yes |

|

Other - Correspondence |

No |

Table 3: Document Type Table

for tobacco tax.

i.

Refer

to View Assessment Status to find a reference number for a specific return or

period end.

Step 2 of 3: Choose File(s) (Image 8)

d.

Click

on ‘Choose File’ to select a file to upload.

e.

Enter

a brief description of the document in the ‘Document Description’ field.

f.

Select

‘Add More Documents’ to upload more files.

g.

Select

‘Review’ once all files have been uploaded.

Image 8: Select Documents

Step 3 of 3: Review & Submit

h.

Review

the select files and document descriptions provided.

i.

Select

‘Previous’ to add more files or make changes.

j.

Select

‘Submit’ to complete the upload.