Completing the Return Aviation Fuels

The following steps and screen shots will assist you with completing the

Carbon Levy Remitter Aviation Fuels Return.

For assistance with amending a previously

submitted Aviation Fuel Return, refer to the Amending a Return

guide.

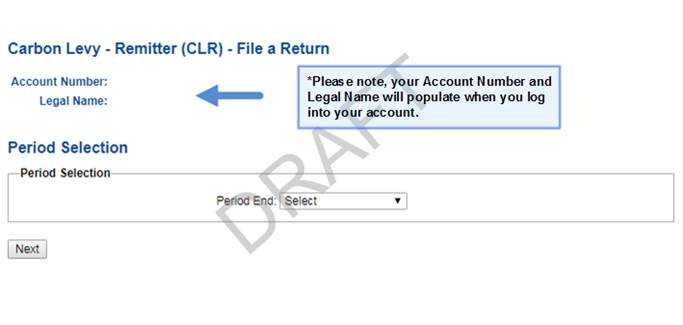

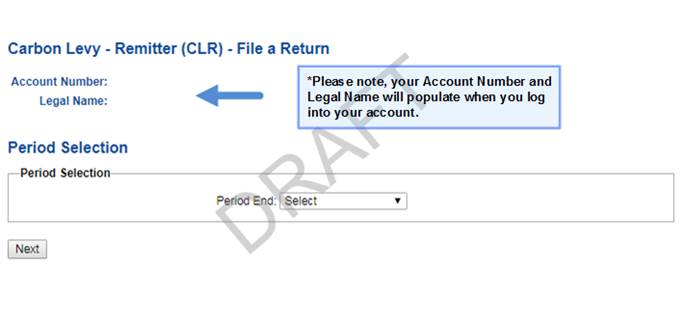

Step 1 of 5: Period End (Image 1)

1. Select the

period end from the drop-down box.

2. Once

completed, select Next.

Image

1: This is how the screen will appear for step 1 of the remitter return.

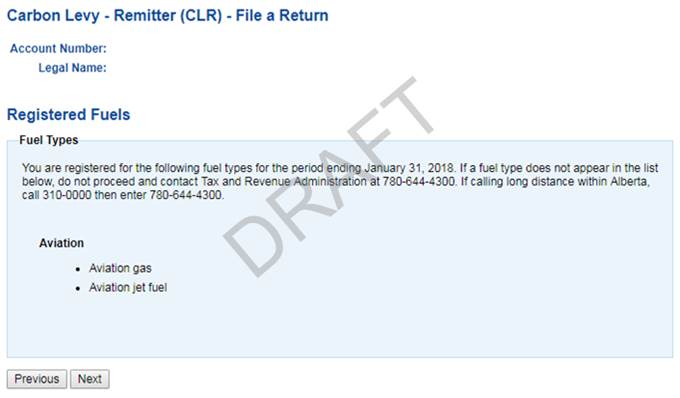

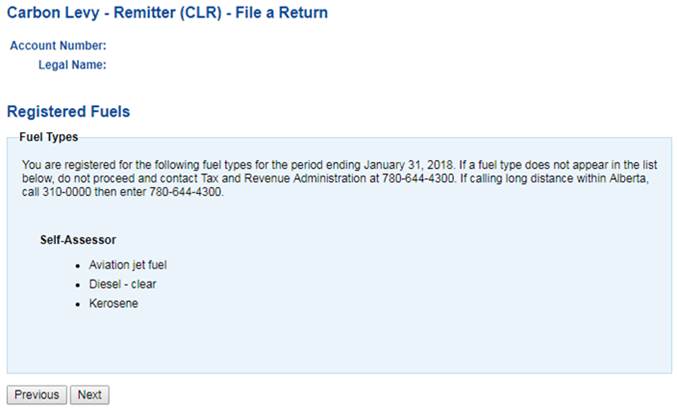

Step 2 of 5: Registered Fuel Types (Image 2)

1. The list of

fuel types you are registered for is displayed. The available fuel types are

those active as of the period end selected.

2. If all

necessary fuel types are listed, select Next.

Image

2: This is how the screen will appear for step 2 of the remitter return.

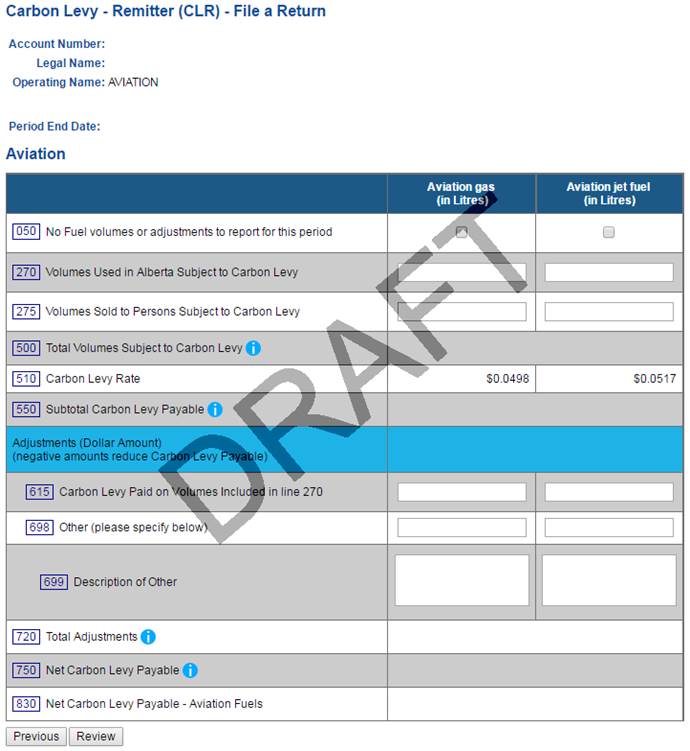

Step 3 of 5: Fuel Reporting

and Adjustments and

Credits (Image 3)

1. Select the box in line 050 if there are no fuel volumes to report for this period.

2. On line

270 report volumes of aviation fuels that were used for flights, or

segments of flights, that departed from a location in Alberta and arrived at a

location in Alberta.

3. On line

275 report volumes of aviation fuels that were acquired exempt from carbon

levy and were subsequently sold to persons subject to the carbon levy.

4. Line 500 will populate the sum of lines 270 and 275

on the review page.

5. Line 510 indicates the specific carbon levy rate per

fuel type.

6. On

line 550, line 500 is multiplied by line 510 and will be visible on the

review page.

7. On line

615 enter the net total of any carbon levy paid when acquiring product that

has been included in Volumes Used in Alberta Subject to Carbon Levy on line

270. Enter amount as a negative number.

8. On

line 698 enter any monetary adjustments for the period.

9. On line

699 enter a text description for the adjustment being claimed on line 698.

10. Line 720 is the sum of lines 615 and 698 which will

appear on the review page.

11. Line 750 is the total of line 550 plus line 720 and

will populate on the review page.

12. Select Review

on the bottom left side of the page.

Image

3: This is how the screen will appear for step 3 of the remitter return.

Step 4 of 5: Review

(Image 4)

1. Verify that all of the information entered is

accurate.

2. Line 750 indicates the carbon levy payable for each

Aviation fuel type.

3. The net amount of carbon levy payable is

shown on Line 830.

4. After the information has been verified,

select Submit.

Image 4: This is how the screen will appear

for step 4 of the remitter return.

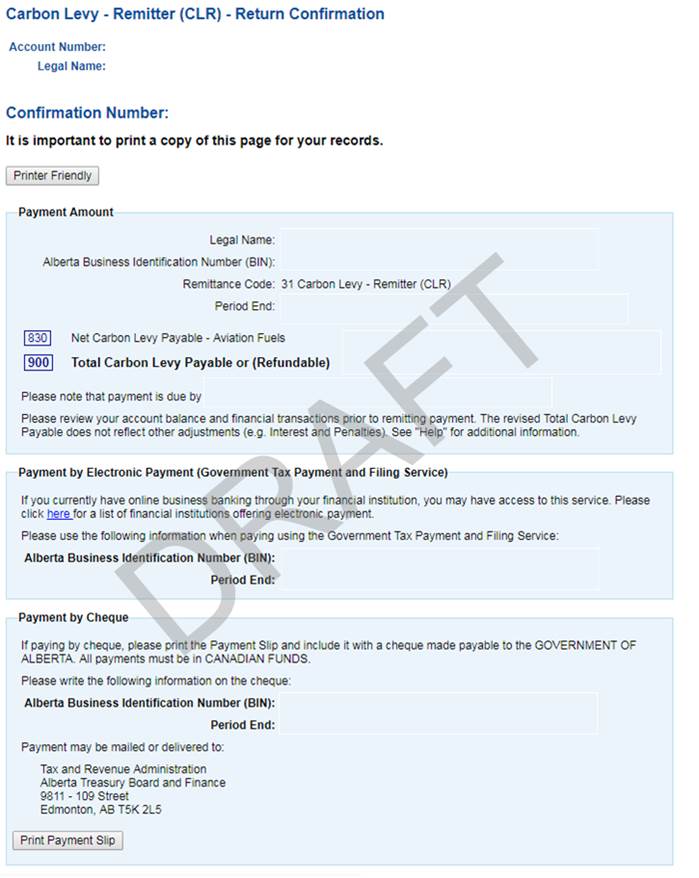

Step 5 of 5:

Confirmation (Image 5)

1. Your Remitter

Return has now been successfully submitted.

2. Print a copy of the summary sheet for your records. The summary cannot

be retrieved once you leave the summary screen.

3. The return must be

submitted to TRA by the 28th day of the month following the period

end.

Image 5: This is how the screen will appear

for step 5 of the remitter return.

Payment

There are several options for remitting the carbon levy payment to

TRA including:

·

pay online using

electronic payment through your financial institution (Government Tax Payment

and Filing Service); or

·

pay by mail,

courier or in person for cheques and money orders (payable to the Government of

Alberta).

For

more information on making a payment to TRA, please see: http://www.finance.alberta.ca/publications/tax_rebates/making-payments.html.

TRA

must receive the payment by the 28th day of the month

following the period end.

If you require further assistance with filing this return, contact us at:

Phone:

780-644-4300 (long distance within Alberta, call 310-0000, then enter

780-644-4300)

Email: tra.carbonlevy@gov.ab.ca

Fax:

780-644-4144

Completing the Return Natural

Gas

The following steps and screen shots will assist you with completing the

Carbon Levy Remitter Natural Gas Return.

For assistance with amending a previously submitted

Natural Gas Return, refer to the Amending a Return guide.

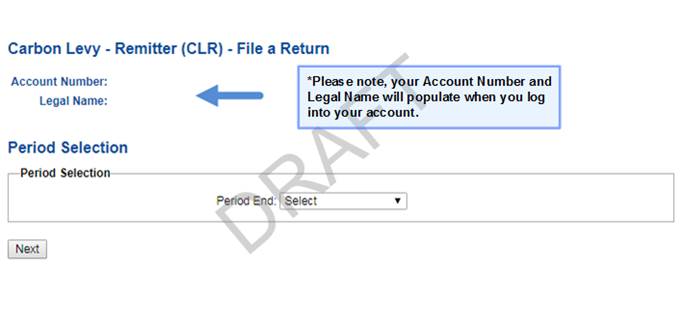

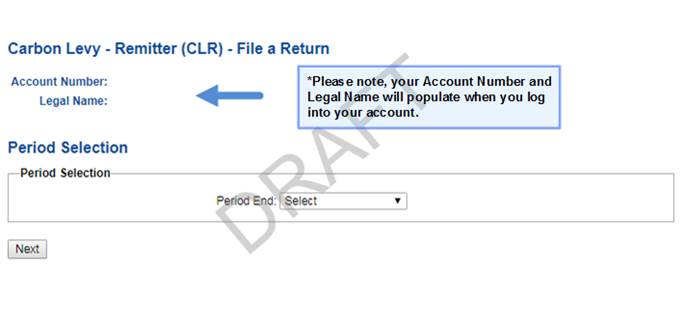

Step 1 of 5: Period End (Image 1)

1.

Select the period end from the drop-down box.

2.

Once completed, select Next.

Image

1: This is how the screen will appear for step 1 of the remitter return.

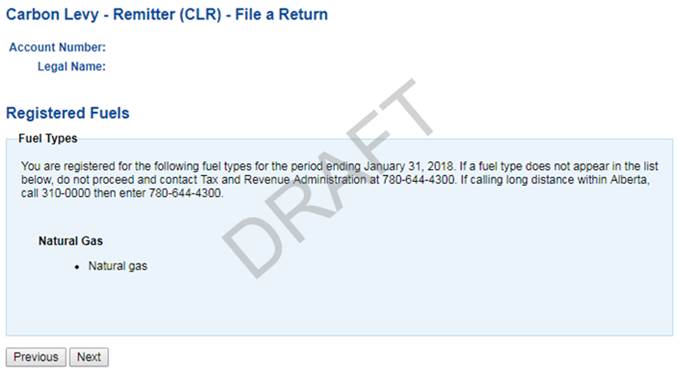

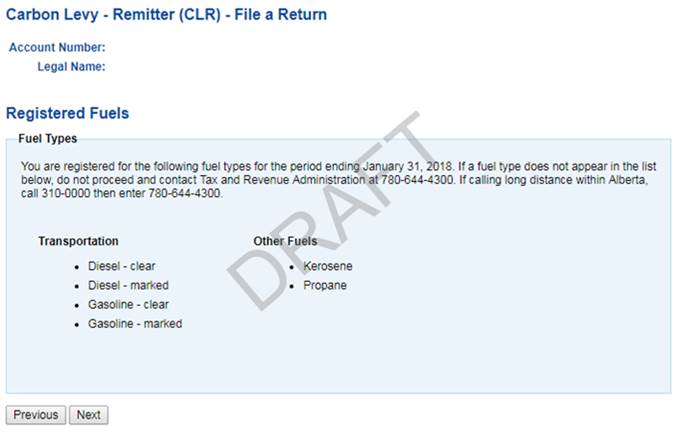

Step 2 of 5: Registered Fuel Types (Image 2)

1. The list of

fuel types you are registered for is displayed. The available fuel types are

those active as of the period end selected.

2. If all

necessary fuel types are listed, select Next.

Image

2: This is how the screen will appear for step 2 of the remitter return.

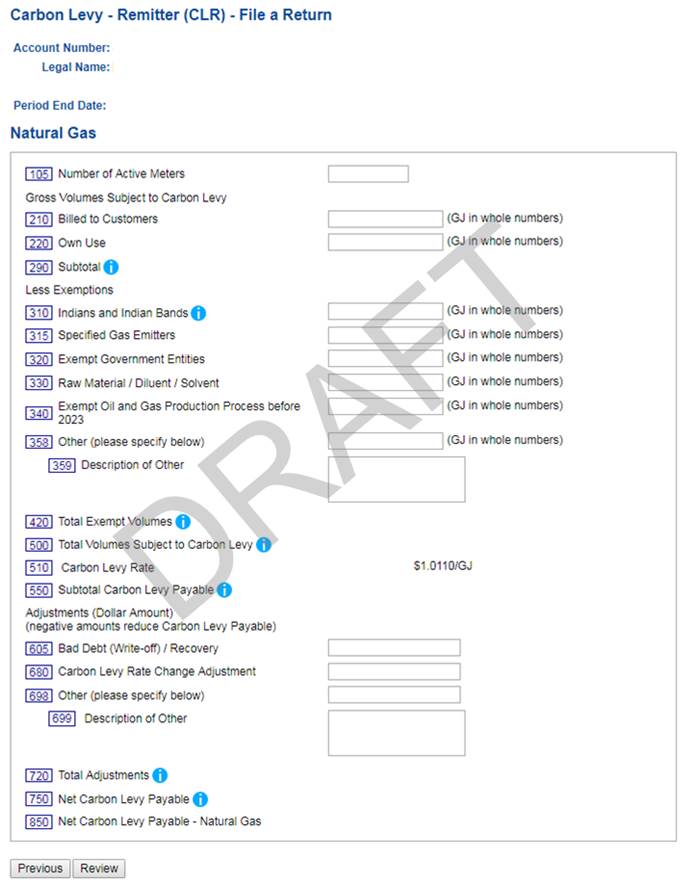

Step 3 of 5: Fuel Reporting and Adjustments and Credits

(Image 3)

1. On line

105 report the number of natural gas meters that were active during the

reporting period.

2. On line

210 report volumes of natural gas that have been billed to customers.

3. On line

220 report volumes of natural gas used in your own operations that are

subject to carbon levy and have not been included in line 210 above.

4. Line 290 will populate the sum of lines 210 and 220

on the review page.

5. On

line 310 report volumes of natural gas sold to eligible Indians and Indian

bands located on a reserve in Alberta who provided evidence of exemption in the

form of a federal identification card or an original certificate.

6. On

line 315 report volumes of natural gas sold to entities in Alberta that

have provided a valid exemption certificate

enabling them to purchase natural gas exempt from carbon levy as an

entity that reports under the Specified Gas Emitters Regulation. The effective

date and active status of exemption certificates can be confirmed online using

the Tax and Revenue Administration Client Self-Service (TRACS) platform.

7. On line

320 report volumes of natural gas sold exempt from carbon levy to the

Government of Canada or armed forces of another country where documentation has

been provided confirming that the fuel is being purchased for use by the

Government of Canada or armed forces of another country.

8. On

line 330 report volumes of natural gas sold to entities in Alberta that

have provided a valid exemption certificate enabling them to purchase natural

gas exempt from carbon levy as an entity that uses the natural gas as a raw

material/diluent/solvent for the purposes of manufacturing, including

petrochemical manufacturing. The effective date and active status of exemption

certificates can be confirmed online using the Tax and Revenue Administration

Client Self-Service (TRACS) platform.

9. On line

340 report volumes of natural gas sold to entities in Alberta that have

provided a valid exemption certificate enabling them to purchase natural gas

exempt from carbon levy as an Oil and Gas Production Process before 2023. The

effective date and active status of exemption certificates can be confirmed

online using the Tax and Revenue Administration Client Self-Service (TRACS)

platform.

10. On

line 358 report volumes of natural gas sold to entities in Alberta for

other exempt uses. Documentation satisfactory to the Minister must be

maintained to support exemption.

11. On line 359 enter a text description of the type of

exemption claimed on line 358 above.

12. Line 420 is the sum of lines 310, 315, 320, 330, 340

and 358 which will populate on the review screen.

13. Line 500 will populate the sum of lines 290 and 420

on the review page.

14. Line 510 indicates the carbon levy rate for natural

gas.

15. On

line 550, line 500 is multiplied by line 510 and will be visible on the

review page.

16. On line

605 enter the dollar total of carbon levy related to bad debts being

reported as written off in the period as a negative amount and any carbon levy on

bad debts that were reported in a prior period that have been subsequently

recovered as a positive amount.

17. On line

680 enter the dollar total of the adjustment resulting from a carbon levy

rate change. This line should be used

when the system has applied the new carbon levy rate to a volume of natural gas

sold under the previous carbon levy rate.

18. On

line 698 enter the net total of any other monetary adjustments for the

period that are not included in lines 605 or 680.

19. On line

699 enter a text description for the adjustment being claimed on line 698.

20. Line 720 is the sum of lines 605, 680 and 698 which

will appear on the review page.

21. Line 750 is the sum of line 550 plus line 720 and

will populate on the review page

22. Select Review

on the bottom left side of the page.

Image

3: This is how the screen will appear for step 3 of the remitter return.

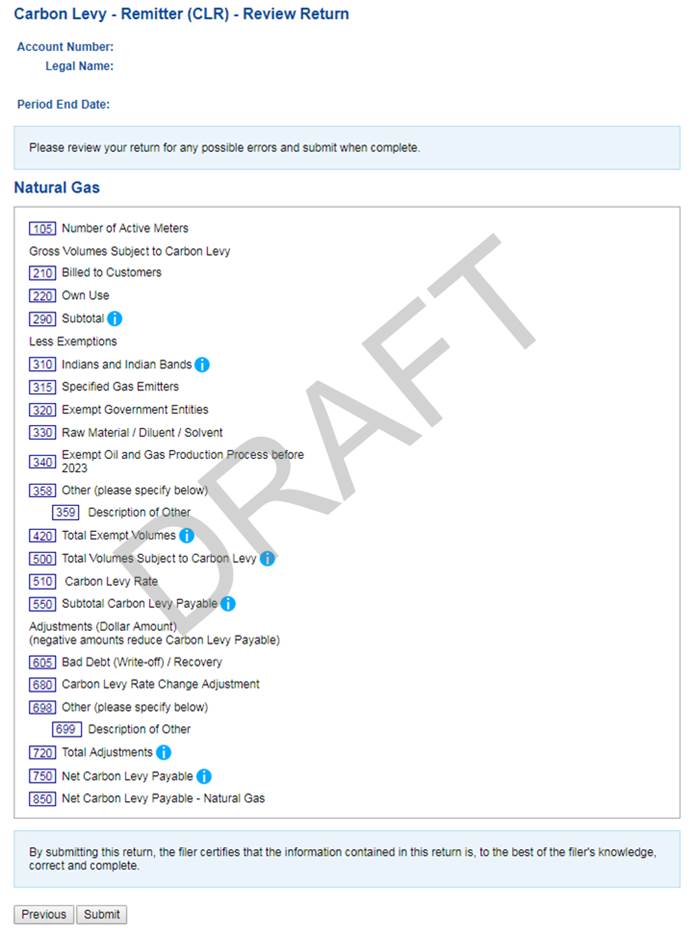

Step 4 of 5: Review

(Image 4)

1. Verify that all of the information entered is

accurate.

2. Line 750 indicates the carbon levy payable for

Natural Gas.

3. The total amount of carbon levy payable is

shown on Line 850.

4. After the information has been verified,

select Submit.

Image 4: This is how the screen

will appear for step 4 of the remitter

return.

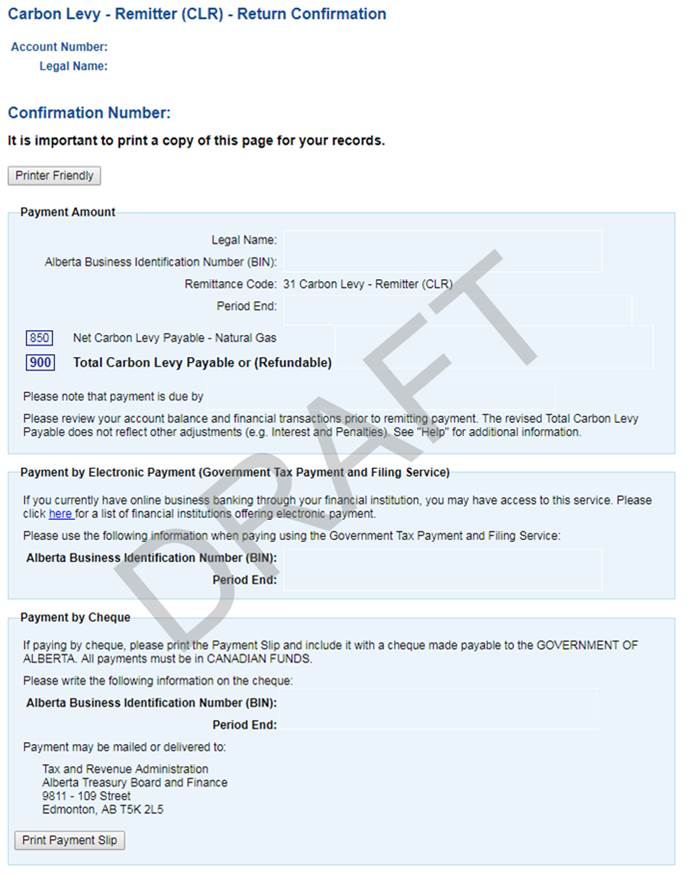

Step 5 of 5:

Confirmation (Image 5)

1. Your Remitter

Return has now been successfully submitted.

2. Print a copy of the summary sheet for your records. The summary cannot

be retrieved once you leave the summary screen.

3. The return must be submitted to TRA by the

28th day of the month following the period end.

Image 5: This is how the screen will appear

for step 5 of the remitter return.

Payment

There are several options for remitting the carbon levy payment to

TRA including:

·

pay online

using electronic payment through your financial institution (Government Tax Payment

and Filing Service); or

·

pay by mail,

courier or in person for cheques and money orders (payable to the Government of

Alberta).

For

more information on making a payment to TRA, please see: http://www.finance.alberta.ca/publications/tax_rebates/making-payments.html.

TRA

must receive the payment by the 28th day of the month

following the period end.

If you require further assistance with filing this return, contact us at:

Phone: 780-644-4300 (long distance within Alberta, call 310-0000, then enter 780-644-4300)

Email: tra.carbonlevy@gov.ab.ca

Fax: 780-644-4144

Completing the Return Other

Fuels

The following steps and screen shots will assist you with completing the

Carbon Levy Remitter Other Fuels Return.

For assistance with amending a previously

submitted Other Fuels Return, refer to the Amending a Return

guide.

Step 1 of 6: Period End (Image 1)

1.

Select the period end from the drop-down

box.

2.

Once completed, select Next.

Image

1: This is how the screen will appear for step 1 of the remitter return.

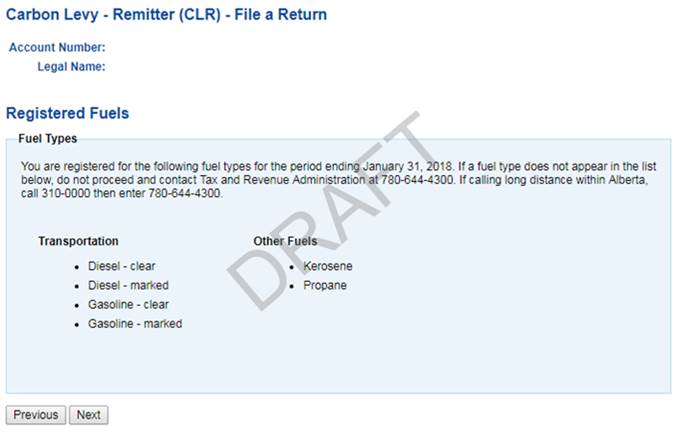

Step 2 of 6: Registered Fuel Types (Image 2)

1. The list of

fuel types you are registered for is displayed. The available fuel types are

those active as of the period end selected.

2. If all

necessary fuel types are listed, select Next.

Image

2: This is how the screen will appear for step 2 of the remitter return.

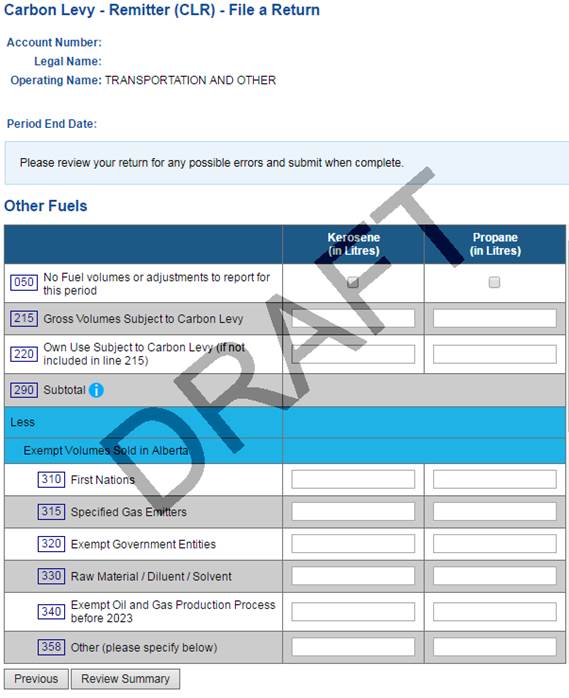

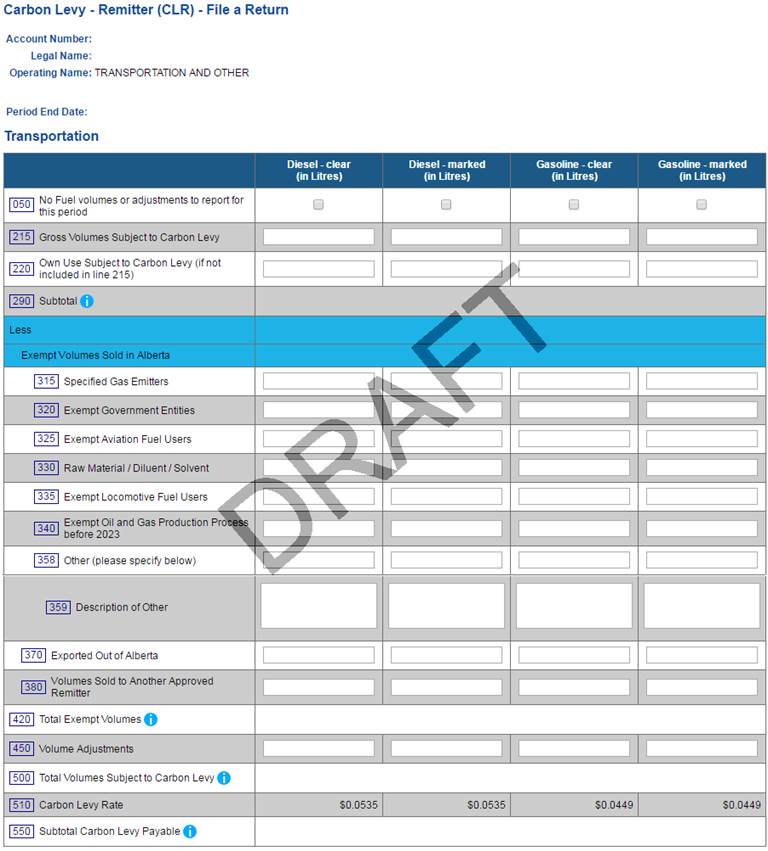

Step 3 of 6: Fuel Reporting and Exempt Volumes (Images 3 and 4)

1. The first screen allows the option to

complete the Transportation Fuels schedule if you are registered for any fuel

types that are filed using this schedule. If you are not registered for fuel

types that are filed using the Transportation Fuels schedule, this schedule

will not appear.

2. If you do not have Transportation Fuels to

report for the period for which you are filing, select the box on line 050 for all approved

transportation fuel types. For assistance with completing the Transportation

Fuels schedule, refer to the Transportation

Fuels Remitter Return Guide.

3. Select Next

on the bottom left side of the screen.

4. Select Review

on the bottom left side of the screen.

5. Select Next

on the bottom left side of the screen.

6. Select the box in line 050 if there are no Other Fuel volumes to report for this

period.

7. The following fuel volumes subject to carbon

levy should be included in line 215

·

Fuel

imported into Alberta that is not delivered to a designated offsite storage

facility, or refinery or terminal designated under the Fuel Tax Act;

·

Fuel sold or

removed from a gas or oil processing system without moving all of the fuel back

into a respective processing system;

·

Miscellaneous

fuels sold in Alberta including: coke oven gas, refinery gas, low heat value

coal, high heat value coal, refinery petroleum coke, upgrader petroleum coke,

and coal coke; and

·

Fuel acquired

from a direct remitter or licence holder in Alberta.

Note: Volumes of

fuel imported into Alberta or acquired in Alberta and delivered to a designated

offsite storage facility, or refinery or terminal designated under the Fuel Tax Act, that remain in inventory

at that facility at the end of a reporting period should be excluded from your

Line 215 Volume.

8. On line

220 report volumes used in your own operations that are subject to carbon

levy and have not been included in Line 215 above.

9. Line 290 is the subtotal of lines 215 and 220 and

will populate on the review page.

10. On line

310 report volumes of fuel sold to eligible Indians and Indian bands

located on a reserve in Alberta who provided evidence of exemption in the form

of a ministerial identification card (AITE card), a federal identification card

or an original certificate.

11. On line

315 report volumes of fuel sold to entities in Alberta that have provided a

valid exemption certificate enabling

them to purchase specific fuels exempt from carbon levy as an entity that

reports under the Specified Gas Emitters Regulation. The effective date and active status of

exemption certificates can be confirmed online using the Tax and Revenue

Administration Client Self-Service (TRACS) platform.

12. On line

320 report volumes of fuel sold exempt from carbon levy to the Government

of Canada or armed forces of another country where documentation has been

provided confirming that the fuel is being purchased for use by the Government

of Canada or armed forces of another country.

13. On line

330 report volumes of fuel sold to entities in Alberta that have provided a

valid exemption certificate enabling them to purchase specific fuels exempt

from carbon levy as an entity that uses the fuel as a raw material/diluent/solvent

for the purposes of manufacturing, including petrochemical manufacturing. The effective date and active status of

exemption certificates can be confirmed online using the Tax and Revenue Administration

Client Self-Service (TRACS) platform.

14. On

line 340 report volumes of fuel sold to entities in Alberta that have

provided a valid exemption certificate enabling them to purchase specific fuels

exempt from carbon levy as an Oil and Gas Production Process before 2023. The effective date and active status of

exemption certificates can be confirmed online using the Tax and Revenue

Administration Client Self-Service (TRACS) platform.

15. On line

358 report volumes of fuel sold to entities in Alberta for other approved

uses. Documentation satisfactory to the

Minister must be maintained to support exemption.

16. On line

359 enter a text description of the type of exemption claimed on line 358

above.

17. On

line 370 report the following volumes:

·

Fuel that

you export from Alberta.

·

Fuel that is sold or removed from a designated offsite storage

facility, or refinery or terminal designated under the Fuel Tax Act,

and evidence satisfactory to the Minister is provided by the purchaser that the

fuel is intended for export from Alberta at the time it is sold.

18. On line

380 report volumes of fuel sold to a licence holder. The effective date and

active status of a licence holder can be confirmed online using the Tax and

Revenue Administration Client Self-Service (TRACS) platform.

19. Line 420 is the sum lines 310, 315, 320, 330, 340,

358, 370 and 380 which will populate on the review page.

20. On

line 450 report any miscellaneous verifiable volume adjustments that are

not reflected in any other volume reported on a different line on the return.

21. Line 500 is line 290 less line 420 plus or minus line

450 and will be visible on the review page.

22. Line 510 indicates the specific carbon levy rate per

fuel type

23. Line

550 is line 500 is multiplied by line 510 and will be visible on the review

page.

Image 3: This is how the screen

will appear for step 3 (Transportation Fuels) of the remitter return.

Image

4: This is how the screen will appear for step 3 (Other Fuels) of the remitter

return.

Step 4 of 6: Adjustments and Credits (Image 5)

1.

On line 605 enter the dollar total of

carbon levy related to bad debts being reported as written off in the period as

a negative amount and any carbon levy on bad debts that were reported in a

prior period that have been subsequently recovered as a positive amount.

2.

On line 610 enter the carbon levy

previously remitted on product that was destroyed, contaminated, etc., as a

negative amount.

3. On line

615 enter the net total of any carbon levy paid when acquiring product that

has been included in this months Gross Volumes Subject to Carbon Levy on line

290 as a negative amount.

4.

On line 698 enter the net total of any

other monetary adjustments for the period that are not reflected in lines 605,

610, or 615.

5.

On line 699 enter a text description for

the adjustment being claimed on line 698.

6. Line 720 is the sum of lines 605, 610, 615, and 698

which will appear on the review page.

7. Line 750 is the total of line 550 plus line 720 and

will populate on the review page.

8. Select Review

on the bottom left side of the page.

Image

5: This is how the screen will appear for step 4 of the remitter return.

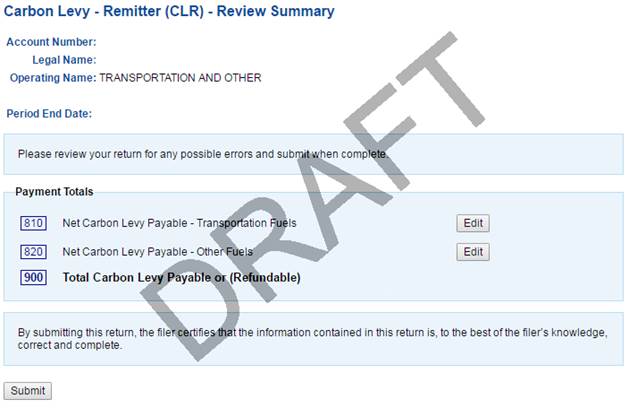

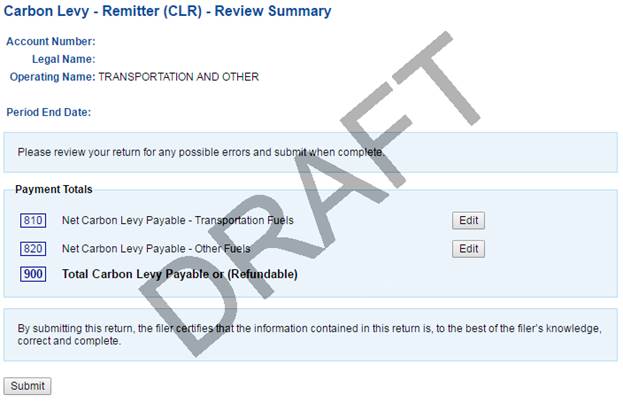

Step 5 of 6: Review

(Images 6 and 7)

1. Verify that all of the information entered is

accurate.

2.

Select Review Summary

3.

Line 810 indicates the carbon levy payable for Transportation Fuels.

4.

Line 820 indicates the carbon levy payable for Other Fuels.

5. The total amount of carbon levy payable or

refundable is shown on Line 900.

6. After the information has been verified,

select Submit.

Image

6: This is how the screen will appear for step 5 of the remitter return.

Image 7: This is how the screen will appear

for step 5 of the remitter

return.

Step 6 of 6:

Confirmation (Image 8)

1. Your Remitter

Return has now been successfully submitted.

2. Print a copy of the summary sheet for your records. The summary cannot

be retrieved once you leave the summary screen.

3. The return must be submitted to TRA by the 28th day of the month following the period end.

Image 8:

This is how the screen will appear for step 6 of the remitter return.

Payment

There are several options for remitting the carbon levy payment to

TRA including:

·

pay online

using electronic payment through your financial institution (Government Tax

Payment and Filing Service); or

·

pay by mail,

courier or in person for cheques and money orders (payable to the Government of

Alberta).

For more information on making a payment to TRA, please see:

http://www.finance.alberta.ca/publications/tax_rebates/making-payments.html.

TRA

must receive the payment by the 28th day of the month

following the period end.

If you require further assistance with filing this return, contact us at:

Phone: 780-644-4300 (long distance within Alberta, call 310-0000, then enter 780-644-4300)

Email: tra.carbonlevy@gov.ab.ca

Fax: 780-644-4144

Completing the Return Locomotive Fuels

The following steps and screen shots will assist you with completing the

Carbon Levy Remitter Locomotive Fuel User Return.

For assistance with amending a previously

submitted Locomotive Fuels Return, refer to the Amending a

Return guide.

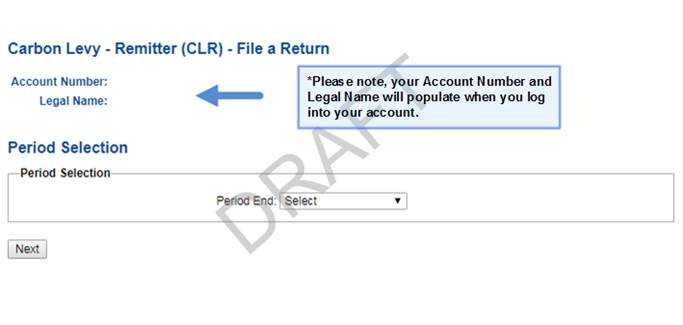

Step 1 of 5: Period End (Image 1)

1.

Select the period end from the drop-down

box.

2. Once completed, select Next.

Image 1: This is how the

screen will appear for step 1 of the remitter return.

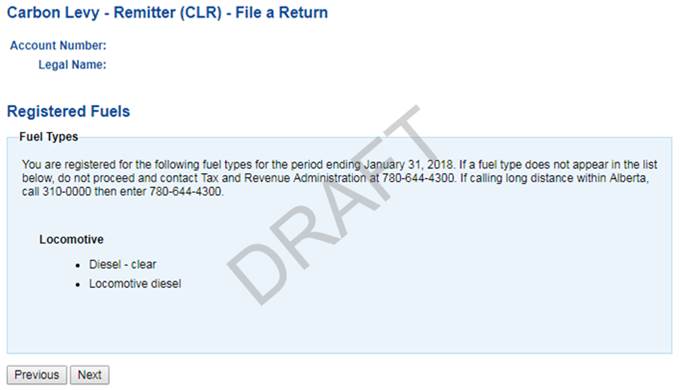

Step 2 of 5: Registered Fuel Types (Image 2)

1. The list of

fuel types you are registered for is displayed. The available fuel types are

those active as of the period end selected.

2. If all

necessary fuel types are listed, select Next.

Image

2: This is how the screen will appear for step 2 of the remitter return.

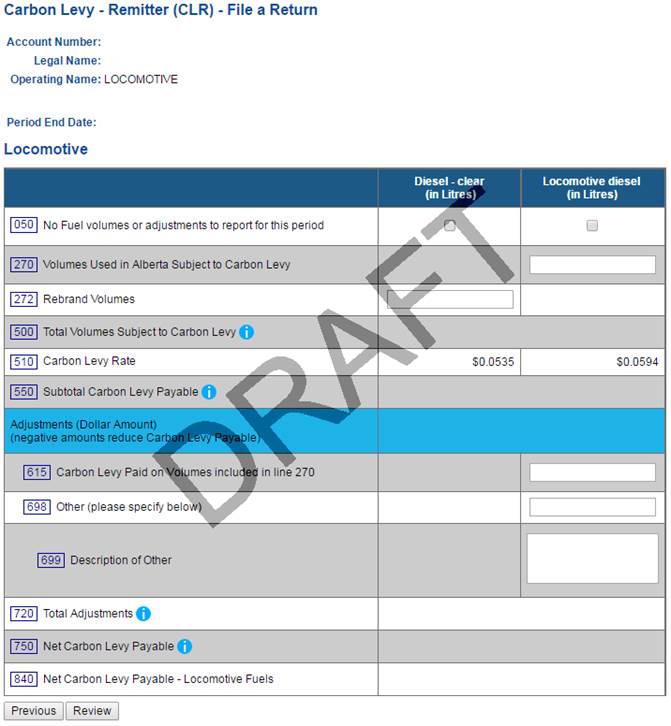

Step 3

of 5: Fuel Reporting and Adjustments and Credits

(Image 3)

1.

Select the

box in line 050 if there are no fuel

volumes to report for this period.

2.

On line 270 report volumes of locomotive

fuels that were used for the operation of a railway locomotive in Alberta.

3.

On line 272 report volumes of diesel fuel

acquired including the carbon levy that were rebranded to locomotive fuel and

used in the operation of a railway locomotive in Alberta.

4.

Line 500 will populate the sum of lines 270 and 272 on the review page. The

system converts the volume in line 272 to a negative number to accommodate the

calculation of the rebrand.

5.

Line 510 indicates the specific carbon levy rate per fuel type.

6. On

line 550, line 500 is multiplied by line 510 and will be visible on the

review page.

7. On line

615 enter the carbon levy paid when acquiring product that has been

included in Volumes Used in Alberta Subject to Carbon Levy on line 270. Enter

amount as a negative number.

8. On

line 698 enter any monetary adjustments for the period.

9. On line

699 enter a text description for the adjustment being claimed on line 698.

10. Line 720 is the sum of lines 615 and 698 which will

appear on the review page.

11. Line 750 is the sum of line 550 plus line 720

(Locomotive Fuel) and line 550 amount (Diesel) displayed in separate columns

and will populate on the review page.

12. Select Review on the bottom left side of

the page.

Image 3: This is how the screen

will appear for step 3 of the remitter return.

Step 4 of 5: Review

(Image 4)

1. Verify that all of the information entered is

accurate.

2. Line 750 indicates the carbon levy payable for each

Locomotive fuel type.

3. The total amount of carbon levy payable is

shown on Line 840.

4. After the information has been verified,

select Submit.

Image 4: This is how the

screen will appear for step 4 of the remitter return.

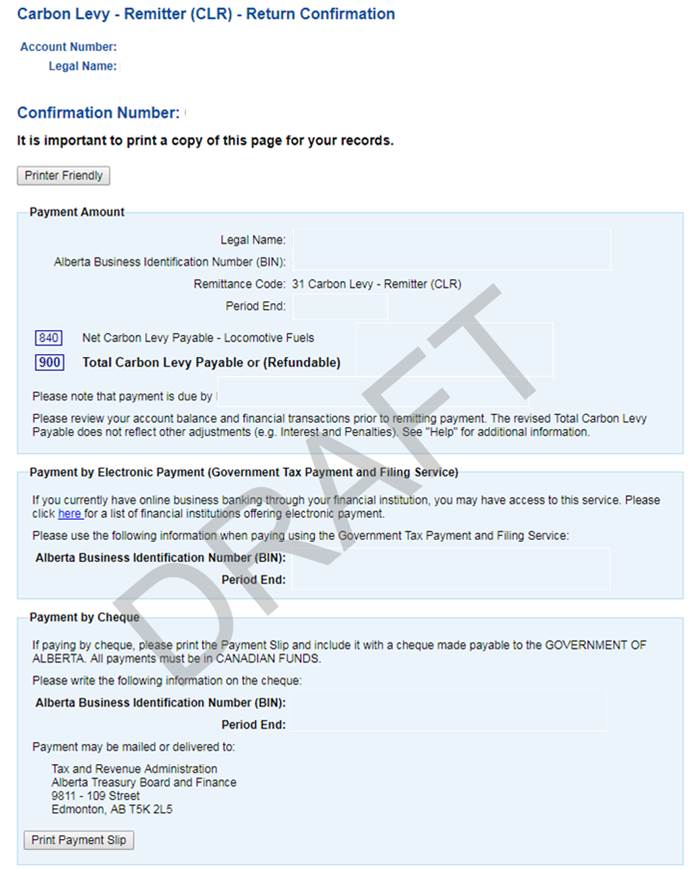

Step 5 of 5:

Confirmation (Image 5)

1. Your Remitter

Return has now been successfully submitted.

2. Print a copy of the summary sheet for your records. The summary cannot

be retrieved once you leave the summary screen.

3. The return must be submitted to TRA by the

28th day of the month following the period end.

Image 5: This is how the screen will appear

for step 5 of the remitter

return.

Payment

There are several options for remitting the carbon levy payment to

TRA including:

·

pay online using

electronic payment through your financial institution (Government Tax Payment

and Filing Service); or

·

pay by mail,

courier or in person for cheques and money orders (payable to the Government of

Alberta).

For

more information on making a payment to TRA, please see: http://www.finance.alberta.ca/publications/tax_rebates/making-payments.html.

TRA

must receive the payment by the 28th day of the month

following the period end.

If you require further

assistance with filing

this return, contact us at:

Phone: 780-644-4300 (long distance within Alberta, call 310-0000, then enter 780-644-4300)

Email: tra.carbonlevy@gov.ab.ca

Fax: 780-644-4144

Completing the Return

Self-Assessor

The following steps and screen shots will assist you with completing the

Carbon Levy Remitter Self-Assessor Return.

For assistance with amending a previously submitted

Self-Assessor Return, refer to the Amending a Return

guide.

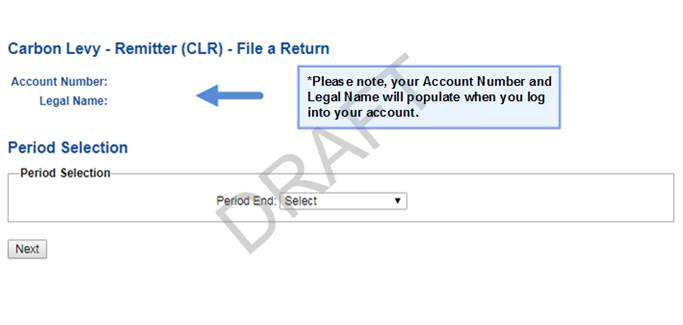

Step 1 of 5: Period End (Image 1)

1. Select the

period end from the drop-down box.

2. Once

completed, select Next.

Image

1: This is how the screen will appear for step 1 of the remitter return.

Step 2 of 5: Registered Fuel Types (Image 2)

1. The list of

fuel types you are registered for is displayed. The available fuel types are

those active as of the period end selected.

2. If all

necessary fuel types are listed, select Next.

Image

2: This is how the screen will appear for step 2 of the remitter return.

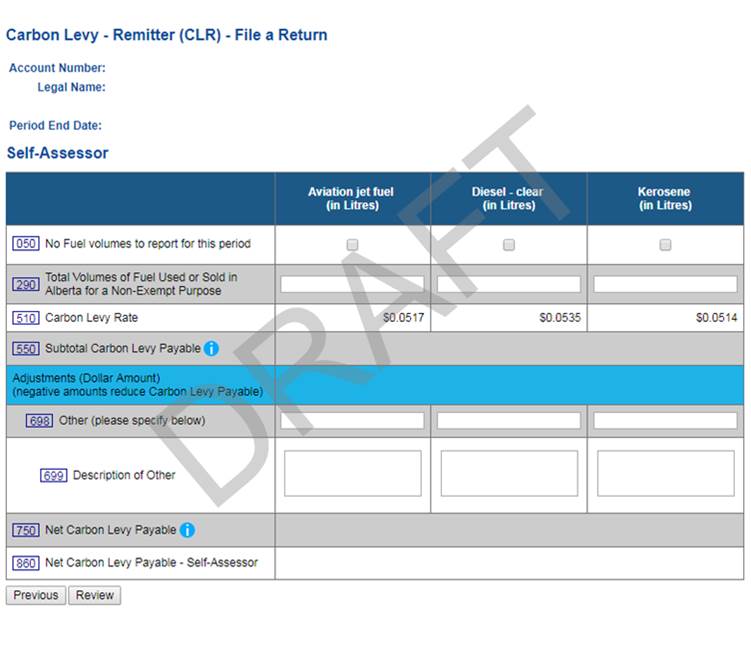

Step 3 of 5: Fuel Reporting

and Adjustments and Credits

(Image 3)

1. Select the box in line 050 if there are no fuel volumes to report for this period.

2. On line

290 report volumes of self-assessor fuels that were acquired exempt from

carbon levy and were subsequently used for a non-exempt purposes or sold to

persons subject to the carbon levy.

3. Line 510 indicates the specific carbon levy rate per

fuel type.

4. On

line 550, line 500 is multiplied by line 510 and will be visible on the

review page.

5. On

line 698 enter any monetary adjustments for the period.

6. On line

699 enter a text description for the adjustment being claimed on line 698.

7. Line 750 is the total of line 550 plus line 720 and

will populate on the review page.

8. Select Review

on the bottom left side of the page.

Image

3: This is how the screen will appear for step 3 of the remitter return.

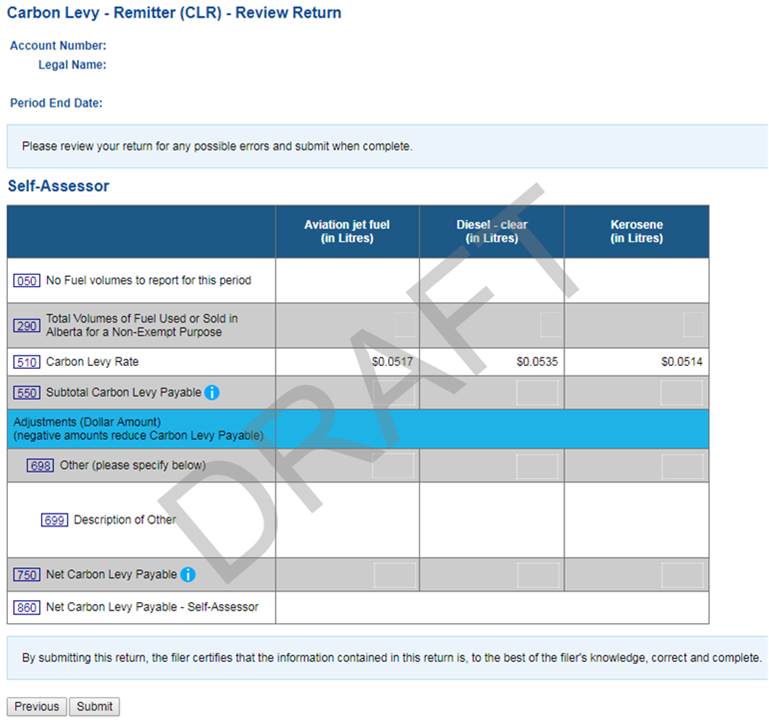

Step 4 of 5: Review

(Image 4)

1. Verify that all of the information entered is

accurate.

2. Line 750 indicates the carbon levy payable for each

Self-Assessor fuel type.

3. The net amount of carbon levy payable is

shown on Line 860.

4. After the information has been verified,

select Submit.

Image 4: This is how the screen will appear

for step 4 of the remitter return.

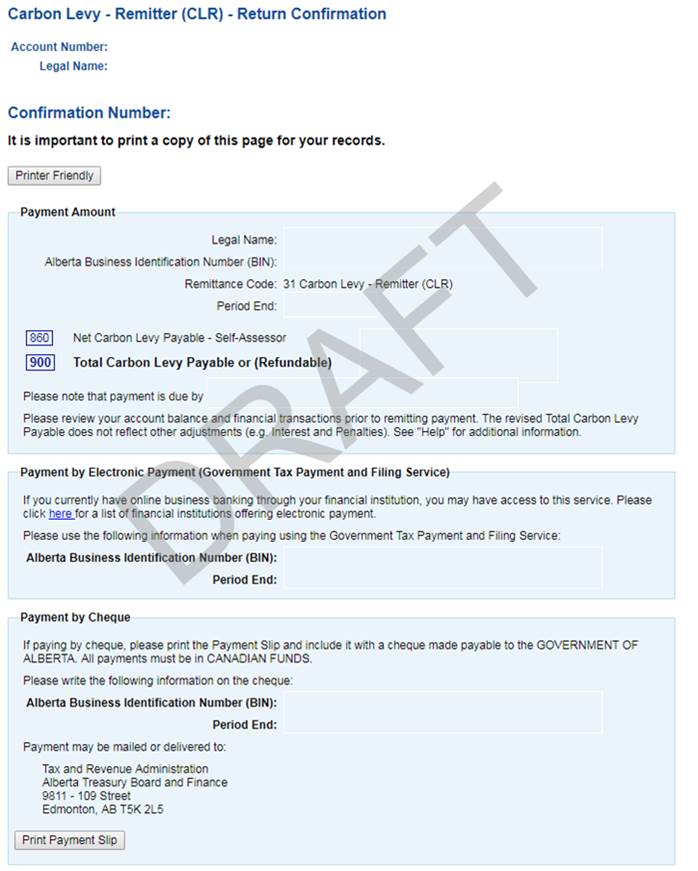

Step 5 of 5:

Confirmation (Image 5)

1. Your Remitter

Return has now been successfully submitted.

2. Print a copy of the summary sheet for your records. The summary cannot

be retrieved once you leave the summary screen.

3. The return must be

submitted to TRA by the 28th day of the month following the period

end.

Image 5: This is how the screen will appear

for step 5 of the remitter return.

Payment

There are several options for remitting the carbon levy payment to

TRA including:

·

pay online using

electronic payment through your financial institution (Government Tax Payment

and Filing Service); or

·

pay by mail,

courier or in person for cheques and money orders (payable to the Government of

Alberta).

For

more information on making a payment to TRA, please see: http://www.finance.alberta.ca/publications/tax_rebates/making-payments.html.

TRA

must receive the payment by the 28th day of the month

following the period end.

If you require further assistance with filing this return, contact us at:

Phone:

780-644-4300 (long distance within Alberta, call 310-0000, then enter

780-644-4300)

Email: tra.carbonlevy@gov.ab.ca

Fax:

780-644-4144

Completing the Return Transportation Fuels

The following steps and screen shots will assist you with completing the

Carbon Levy Remitter Transportation Fuels Return.

For assistance with amending a previously

submitted Transportation Fuels Return, refer to the Amending a

Return guide.

Step 1 of 8: Period End (Image 1)

1.

Select the period end from the drop-down

box.

2. Once completed,

select Next.

Image 1: This is how the screen

will appear for step 1 of the remitter return.

Step 2 of 8: Registered Fuel Types (Image 2)

1. The list of

fuel types you are registered for is displayed. The available fuel types are

those active as of the period end selected.

2. If all

necessary fuel types are listed, select Next.

Image

2: This is how the screen will appear for step 2 of the remitter return.

Step 3 of 8: Fuel Reporting and Exempt Volumes (Image 3)

1.

Select the

box in line 050 if there are no

Transportation Fuel volumes to report for this period.

2. The following fuel volumes subject to carbon

levy should be included in line 215:

·

Fuel

imported into Alberta and sold in Alberta;

·

Fuel sold or

removed from a refinery or terminal, as designated under the Fuel Tax Act in Alberta;

·

Fuel

acquired from a direct remitter, licence holder or, in the case of an approved

Full Direct Remitter (FDR) under the Fuel

Tax Act, the volumes of gasoline, diesel, aviation gas or aviation jet fuel

acquired from another FDR;

·

Natural gas

purchased and removed from a transmission pipeline; or

·

Natural gas

or raw gas sold and removed from a fuel production facility (see

Special Notice, Vol. 11, No. 4) if the natural gas or raw gas is not

delivered into another fuel production facility, transmission pipeline or

natural gas distribution system.

Note:

i.

Volumes of

fuel imported into Alberta or acquired

from a direct remitter, FDR or licence holder in Alberta and delivered to a

refinery or terminal, that remain in inventory at the end of a reporting period

should be excluded from your Line 215 Volume.

ii.

For FDRs,

the value in line 215 should be equivalent to the accountable volumes reported

on the Alberta generic fuel tax return.

3.

On line 220 report volumes used in your

own operations that are subject to carbon levy and have not been included in

Line 215 above.

Note:

i.

Fuel

including natural gas or raw gas that is consumed in the field to operate a

well or other equipment must be included in own use.

4.

Line 290 is the subtotal of lines 215 and 220 and will populate on the

review page.

5.

On line 310 report volumes of fuel other

than gasoline, diesel, and propane for motive use (these fuels are covered

under the Alberta Indian Tax Exemption (AITE) program) sold to eligible Indians

and Indian Bands located on a reserve in Alberta who provided evidence of

exemption in the form of a ministerial identification card (AITE card), a

federal identification or an original certificate.

6.

On line 315 report volumes of fuel sold to

entities in Alberta that have provided a valid exemption certificate enabling them to purchase specific fuels

exempt from carbon levy as an entity that reports under the Specified Gas

Emitters Regulation. The effective date

and active status of exemption certificates can be confirmed online using the

Tax and Revenue Administration Client Self-Service (TRACS) platform.

7.

On line 320 report volumes of fuel sold

exempt from carbon levy to the Government of Canada or armed forces of another

country where documentation has been provided confirming that the fuel is being

purchased for use by the Government of Canada or armed forces of another

country.

8. On line

325:

·

Report volumes of aviation fuel sold to entities that have provided a

valid exemption certificate enabling them to purchase jet fuel and /or aviation

gas exempt from carbon levy. The

effective date and active status of exemption certificates can be confirmed

online using the Tax and Revenue Administration Client Self-Service (TRACS)

platform.

·

Report volumes of aviation fuel sold to foreign air transport service

operators that provide federal documentation establishing eligibility to

purchase aviation fuel exempt of excise tax for international flights.

9.

On line 330 report volumes of fuel sold to

entities in Alberta that have provided a valid exemption certificate enabling

them to purchase specific fuels exempt from carbon levy as an entity that uses

the fuel as a raw material/diluent/solvent for the purposes of manufacturing,

including petrochemical manufacturing.

The effective date and active status of exemption certificates can be

confirmed online using the Tax and Revenue Administration Client Self-Service

(TRACS) platform.

10. On line

335 report volumes of diesel fuel sold to entities in Alberta that are

registered as locomotive fuel users and have a valid Remitter Number. The

effective date and active status of the locomotive fuel users remitter number

can be confirmed online using the Tax and Revenue Administration Client

Self-Service (TRACS) platform.

11. On

line 340 report volumes of fuel sold to entities in Alberta that have

provided a valid exemption certificate enabling them to purchase specific fuels

exempt from carbon levy as an Oil and Gas Production Process before 2023. The

effective date and active status of exemption certificates can be confirmed

online using the Tax and Revenue Administration Client Self-Service (TRACS)

platform.

12. On line

358 report volumes of fuel sold to entities in Alberta for other approved

uses. Documentation satisfactory to the

Minister must be maintained to support exemption.

13. On line

359 enter a text description of the type of exemption claimed on line 358

above.

14. On

line 370 report the following volumes:

·

Fuel that

you export from Alberta.

· Fuel that is sold

or removed from a designated offsite storage facility, or refinery or

terminal designated under the Fuel Tax

Act, and evidence satisfactory to the Minister is

provided by the purchaser that the fuel is intended for export from Alberta at

the time it is sold.

15. On line

380 report volumes of fuel sold to a licence holder, or in the case of a

Full Direct Remitter (FDR) under the Fuel

Tax Act, the volumes of gasoline, diesel, aviation gas or aviation jet fuel

sold to another FDR. The effective

date and active status of a FDR can be confirmed on Treasury Board and

Finances website at www.finance.alberta.ca/publications/tax_rebates/fuel/entities_full_direct_remitters.html

.

The

effective date and active status of a licence holder can be confirmed online

using the Tax and Revenue Administration Client Self-Service (TRACS) platform.

16. Line 420 is the sum lines 315, 320, 325, 330, 335,

340, 358, 370 and 380 which will populate on the review page.

17. On

line 450 report any miscellaneous verifiable volume adjustments that are

not reflected in any other volume reported on a different line on the return.

18. Line 500 is line 290 less line 420 plus or minus line

450 and will be visible on the review page.

19. Line 510 indicates the specific carbon levy rate per

fuel type.

20. Line

550 is line 500 is multiplied by line 510 and will be visible on the review

page.

Image

3: This is how the screen will appear for step 3 of the remitter return.

Step 4 of 8: Adjustments and

Credits (Image 4)

1. On line

605 enter the dollar total of carbon levy related to bad debts being

reported as written off in the period as a negative amount and any carbon levy

on bad debts that were reported in a prior period that have been subsequently

recovered as a positive amount.

2. On line

610 enter the carbon levy previously remitted on product that was

destroyed, contaminated, etc., as a negative amount.

3. On line

615 enter the net total of any carbon levy paid when acquiring product that

has been included in this months Gross Volumes Subject to Carbon Levy on line

290 as a negative amount.

4. On

line 698 enter the net total of any other monetary adjustments for the

period that are not reflected in lines 605, 610, or 615.

5. On line

699 enter a text description for the adjustment being claimed on line 698.

6. Line 720 is the sum of lines 605, 610, 615, and 698

which will appear on the review page.

7. Line 750 is the total of line 550 plus line 720 and

will populate on the review page.

8. Select Review

on the bottom left side of the page.

Image

4: This is how the screen will appear for step 4 of the remitter return.

Step 5 of 8: Review

Transportation Fuels (Image 5)

1. Verify that all of the information entered is

accurate.

2. Select Next.

Image

5: This is how the screen will appear for step 5 (Transportation Fuels) of the

remitter return.

Step 6 of 8: Other

Fuels (Images 6 and 7)

1. This screen allows the option to complete

Other Fuels. If you do not have Other Fuels to report, select the box on line 050 for all fuel types. If you do

have Other Fuels to report refer to the Other

Fuels Remitter Return Guide.

2. Select Review

on the bottom left side of the page.

3. Verify that all of the information entered is

accurate.

4. Select Review

Summary on the bottom left side of the page.

Image 6: This is how the screen will

appear for step 6 (Other Fuels) of the remitter return.

Image 7: This is how the screen

will appear for step 6 of the remitter return.

Step 7 of 8: Review

Summary (Image 8)

1. Line 810 indicates the carbon levy payable for

Transportation Fuels

2. Line 820 indicates the carbon levy payable for Other

Fuels.

3. The total amount of carbon levy payable or

refundable is shown on Line 900.

4. After the information has been verified, select Submit.

Image 8: This is how the screen will appear

for step 7 of the remitter

return.

Step 8 of 8:

Confirmation (Image 9)

1. Your Remitter

Return has now been successfully submitted.

2. Print a copy of the summary sheet for your records. The summary cannot

be retrieved once you leave the summary screen.

3. The return must be

submitted to TRA by the 28th day of the month following the period end.

Image 8: This is how the screen will appear

for step 8 of the remitter

return.

Payment

There are several options for remitting the carbon levy payment to

TRA including:

·

pay online

using electronic payment through your financial institution (Government Tax Payment

and Filing Service); or

·

pay by mail,

courier or in person for cheques and money orders (payable to the Government of

Alberta).

For

more information on making a payment to TRA, please see: http://www.finance.alberta.ca/publications/tax_rebates/making-payments.html.

TRA

must receive the payment by the 28th day of the month

following the period end.

If you require further assistance with filing this return, contact us at:

Phone: 780-644-4300 (long distance within Alberta, call 310-0000, then enter 780-644-4300)

Email: tra.carbonlevy@gov.ab.ca

Fax: 780-644-4144

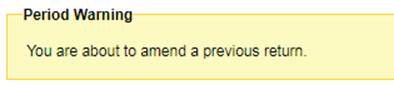

Amending a

Return

You can amend a return for a period that was previously submitted.

1. Choose the

period end you would like to amend and select Next.

2. You will

receive a period warning message on the screen as follows:

3.

Select Next to continue with the amendment.

4.

The assessed

values from the previously submitted return will be available for editing.

Click the field that you are amending and enter the new value. Repeat

this step for all fields requiring an amendment.

5.

When all

amendments are complete, click Review.

6.

Verify that all

of the information entered is accurate.

7.

Select Submit.