Carbon Levy – Exemption Listing Report Help

Exemption

Listing Report

The

Exemption Listing Report will not show the legal name at this time due to

privacy considerations. The report can be

searched by exemption number using the ‘Ctrl F’ function. Once you have found the correct exemption

number, you can confirm the fuel type(s) they are eligible to acquire exempt of

the carbon levy.

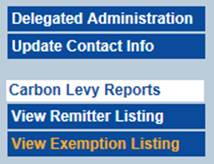

To view this

report, select Exemption Listing

from the menu on the left side of the screen.

Choose the

type of report you want to view. You

will see both the Transportation and Other Fuels Exemption List and the Natural

Gas Exemption List if you are approved for both Natural Gas and at least one

other type of fuel.

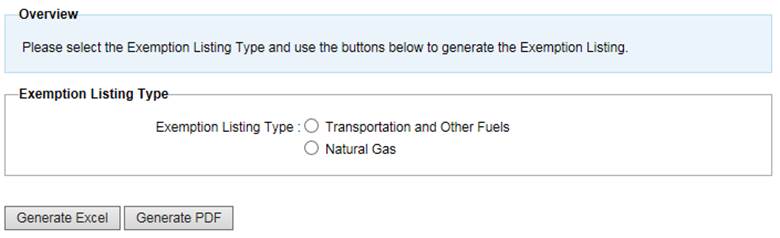

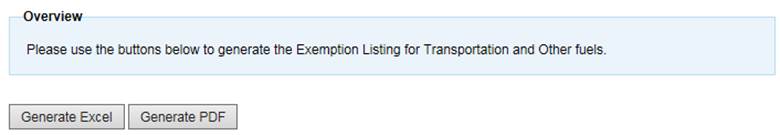

If you are

approved as a direct remitter only for Natural Gas, or only for one or more fuel

types other than Natural Gas, you will not need to select the Exemption Listing

Type. Instead, you will see the following screen:

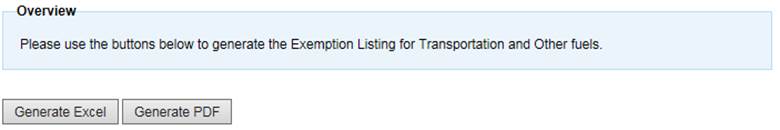

Generate the Exemption Listing Report - Excel

1) Select “Generate Excel”

2) Click on “Open” if asked “Do you want to open or save…”

3) Click on “Yes” if asked “The file you are trying to open, ‘download.xls’, is in a different format…”

4) Save, format, sort and filter the data in order to verify your customers’ eligibility.

![]()

5) Ensure that each specific fuel type has an “Active” status and the Fuel Type Effective Date is on or before the sale date. The fuel type is not exempt from the carbon levy if there is an “Inactive” status and your sale date is before the Fuel Type Effective Date or after the Fuel Type Inactive Date.

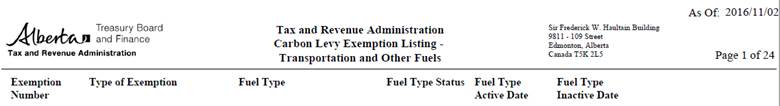

Generate the Exemption Listing Report – PDF

1) Select “Generate PDF”

2) The report will open in a new browser window.

The As Of: Date is the date the report was run on.

3) To find a specific exemption number, key Ctrl F to use the Find function in the PDF document.

Enter the exemption number as it appears on the Exemption Certificate provided by your customer.

4) Ensure that each specific fuel type has an “Active” status and the Fuel Type Active Date is on or before the sale date. The fuel type is not exempt from the carbon levy if there is an “Inactive” status and your sale date is before the Fuel Type Active Date or after the Fuel Type Inactive Date.